Paving the way to financial freedom for youth from coast-to-coast.

Canada’s largest student-run non-profit organization dedicated to the advancement of financial literacy.

Paving the way to financial freedom for youth from coast-to-coast.

Canada’s largest student-run non-profit organization dedicated to the advancement of financial literacy.

OUR MISSION

To equip all Canadian youth with the knowledge and confidence to make informed financial decisions.

Our financial literacy curriculum is designed to leave a lasting impact on our students by teaching lessons such as Mindful Spending, Banking 101, Savings, Credit, and more.

OUR MODEL

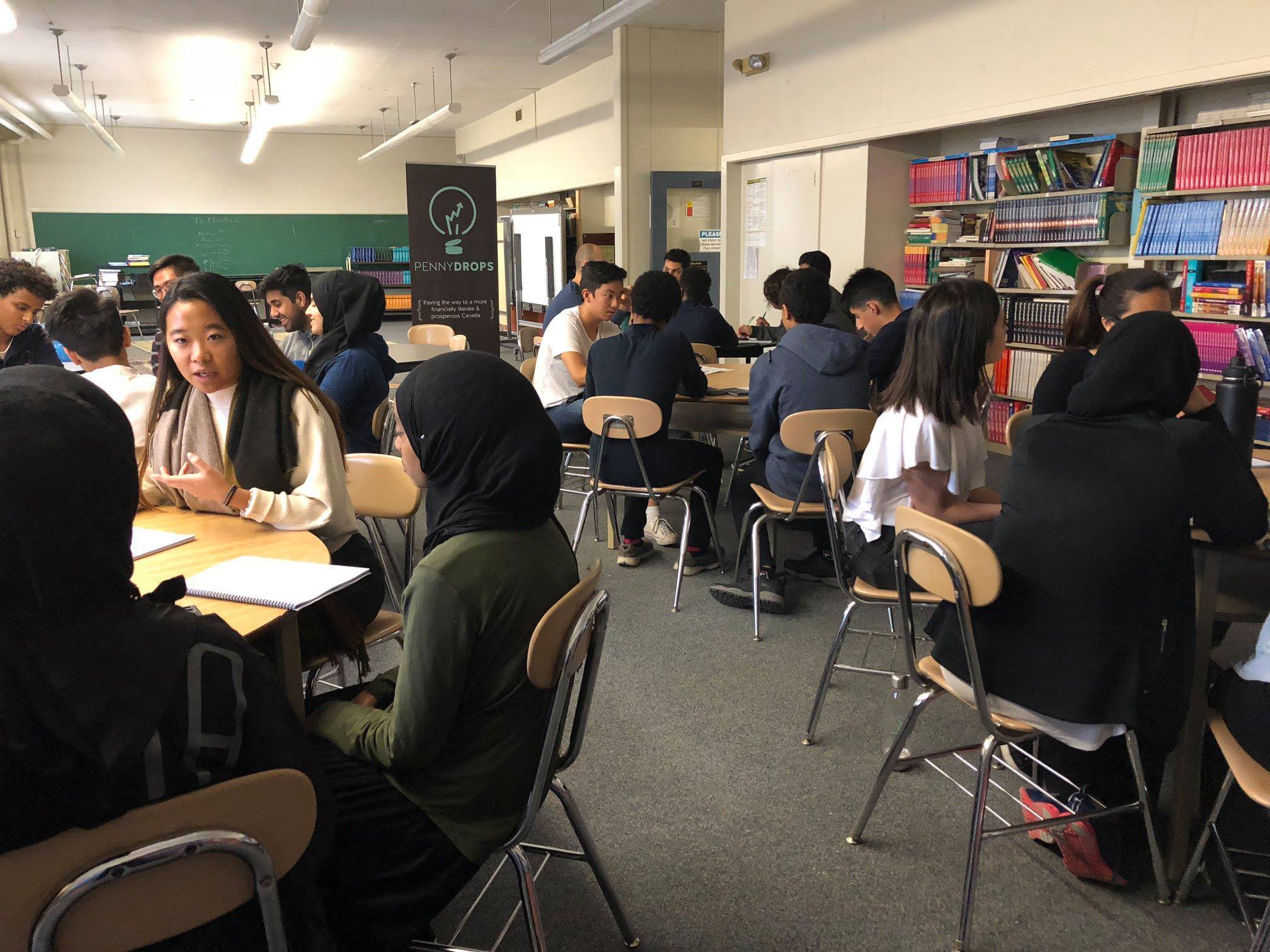

Students teaching students.

We know money is not always easy to talk about. Our programs are delivered by trained university-level mentors. The peer-to-peer dynamic fosters a safe and friendly environment to encourage open discussions about finances. Who better to impact students than students themselves?

OUR PROGRAMS

Our chapters located at universities across Canada run our High School Program and University Program within their local communities.

High School Program

A program tailored for students who are entering the workforce or post-secondary education, first-time users of banking products or discovering the intricacies of personal finance.

University Program

A program tailored for students who are entering university or the professional job market, looking to achieve their financial goals and interested in having an in-depth look at personal finance.

Financial Literacy. Anytime, anywhere.

PennyDrops Anywhere is our new fully-online financial literacy learning platform. Students will learn key financial skills and concepts by working through interactive activities at their own pace.